Last night the federal treasurer, Mr Josh Frydenberg, announced changes to the qualification rules for JobKeeper 2.0.

JobKeeper 2.0 will kick off from 28 September 2020 and continue through to 28 March 2021. This comprises 13 fortnights (6 months). The 13-fortnight period will be further divided into 2 periods called:

- the 1st extension period (being the first 7 fortnights); and

- the 2nd extension period (being the next 6 fortnights).

Requalification – decline in turnover test – JobKeeper 2.0

Qualifying for JobKeeper 2.0 does require that a new decline in turnover test be satisfied. The decline percentages used in JobKeeper 1.0 remain – i.e.

- 30% turnover decline for businesses with group-wide turnover of $1 billion or less

- 50% turnover decline for other businesses; and

- 15% for certain not-for-profits

(**Note that further reference to a 30% turnover decline means that, or the relevant decline percentages for your situation as outlined above).

However, qualification for the JobKeeper 2.0 payments will be based on actual turnover results. This will require businesses to look back at their actual results as opposed to estimating their expected turnover. As no predictions will be required, a lot of uncertainty about who does and who doesn’t qualify will be eliminated.

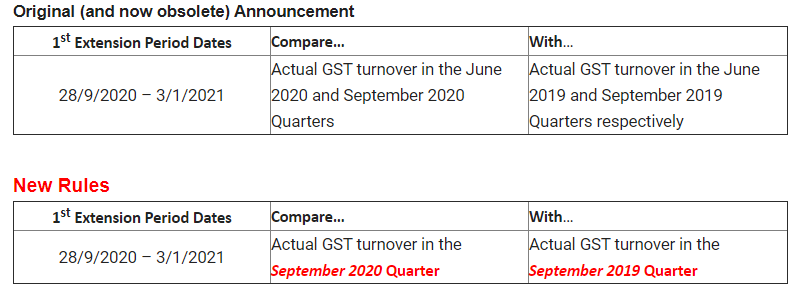

1st EXTENSION PERIOD: 28 September 2020 to 3 January 2021 (the first 7 fortnights)

The Treasurer announced last night that changes have been made to the qualifying criteria for JobKeeper 2.0. the changes are outlined below.

The 1st Extension Period of JobKeeper 2.0, a business must make the following comparisons:

To pass the new test, there must be a decline in turnover of at least 30% ** in the September quarter. The turnover figures can generally be taken from your Business Activity Statements (BAS). The Commissioner of Taxation will have discretion to set out alternative tests that would establish eligibility in specific circumstances where it is not appropriate to compare actual turnover in a quarter in 2020 with actual turnover in a quarter in 2019. Information about the existing discretion can be found Here .

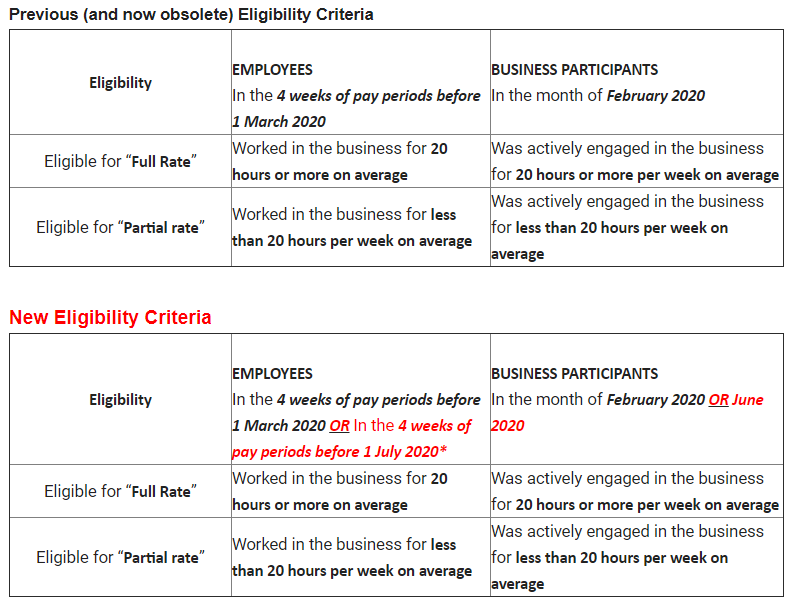

Reduced Payment Rates

The 1st Extension Period has two fortnightly payments rates – A “full rate” of $1,200 and a “partial rate” of $750. Eligibility for these rates for employees or ‘Business Participants’ is as follows:

*The reference period for employees regarding their hours worked to determine their tier of payment will be the two fortnightly pay periods prior to 1 March 2020 or 1 July 2020. The period with the higher number of hours is to be used for employees who were eligible at 1 March 2020.

The ATO will provide guidance where a business’s pay periods do not neatly fit into weekly or fortnightly periods. You will need to analyse your payroll records from February this year to determine which rate applies to each or your eligible employees. (There are no changes to the conditions for being an eligible employee.) That will also determine the minimum amount that you must pay to each individual eligible employee ($1,200 or $750, as applicable, pre-tax) in each JobKeeper fortnight.

Once you have determined whether an eligible employee was above or below that 20-hour threshold, the applicable higher or lower rate will apply to that employee for both extension periods.

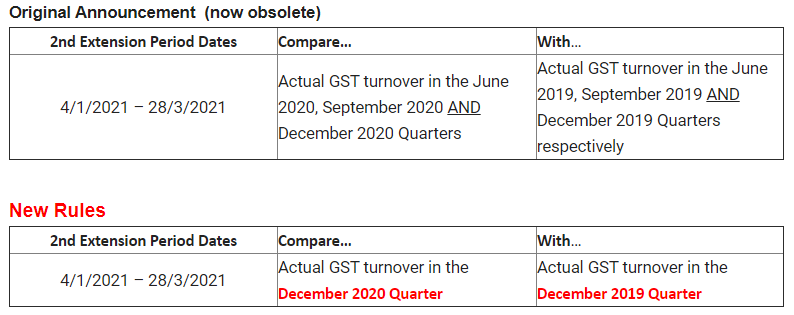

2nd EXTENSION PERIOD: 4 January 2021 to 28 March 2021

The 2nd extension period operates much the same, but with two key differences.

Firstly, you must again re-test decline in turnover, by comparing:

To pass the test, there must be a decline in turnover of at least 30% **.

Secondly, the “full” and “partial” payment rates fall to $1,000 and $650 respectively.

If you would like to read the full treasury statement (which included examples), please click here.

We are sure questions will arise from the above information. Please direct any queries you have to us.

Yours faithfully,

The team at

Brett Wiseman – Director

brett@interacctbc.com.au Ph: 0402 281 888

James Rogalski – Director

james@interacctbc.com.au Ph: 0428 858 818

Carly Thornton – Director

carly@interacctbc.com.au Ph: 0438 007 054

Cherie Parker – Accountant

cherie@interacctbc.com.au Ph: 08 8683 3077

Tracey Barnes – Accountant

tracey@interacctbc.com.au Ph: 0429 906 661

Monique Catanzariti – Accountant

monique@interacctbc.com.au Ph: 0400 041 589

Jane Aird & Sharon Tiller – Office admin

info@interacctbc.com.au Ph: 08 8683 3077