Have you obtained your director ID? Make sure you do.

The director identification number (director ID) regime is now in place with Australia’s newest company directors having to comply first.

Director IDs are a unique 15-digit identifier that a director will apply for once and will keep forever, similar to a tax file number (TFN). A director can only have one director ID and they must use it for all relevant entities.

Background

In the 2020 federal budget, as part of its Digital Business Plan, the government announced the full implementation of the Modernising Business Registers (MBR) Program. This program unifies the Australian Business Register and 31 business registers administered by ASIC into a single platform and introduces the director ID initiative.

Director IDs are intended to prevent false or fraudulent registration of directors, to enable regulators to better trace directors’ relationships with companies, so as to facilitate accountability and traceability. Director IDs will also assist the reduction in phoenixing activities whereby a company is deliberately placed into liquidation, wound up or abandoned to avoid paying its debts (such as superannuation owed to employees, tax owed to the ATO, or debts owed to suppliers/contractors). Under phoenixing, a new company is then started to continue the same business activities…but without the debts.

Who needs to apply?

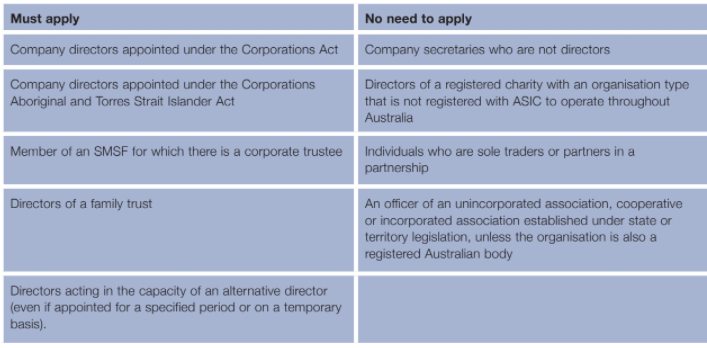

The table on the following page outlines who is and is not required to apply for a director ID. As can be seen, it applies not only to company directors, but to non-business people as well.

When do you need to apply?

The time by which a director ID application must be made depends on the date of appointment as follows:

Therefore, there is some urgency if you are a newly-appointed director from 1 November 2021…you may need to apply for a director ID within 28 days of your appointment.

How do you apply?

Directors will need to apply for a director ID themselves in order to verify their identity. This means that advisers and accountants/tax agents are unable to apply for a director ID on behalf of their director clients.

Directors will need to visit the ABRS website (abrs.gov.au) and click on “Director identification number” near the top of the homepage. Otherwise, directors can scroll down and click on “Apply for your director ID”.

Directors can then follow the three-step process set out on the website:

■ Step 1 – Set-up a myGovID (not the same as myGov)

■ Step 2 – Gather documents required for identification

■ Step 3 – Complete your application

The application process should take less than five minutes and, once complete, the director will instantly receive their director ID. Applicants must provide their TFN, their address as recorded by the ATO, and two basic identification documents. If preferred, directors can also apply for their director ID by telephone or by using paper.

Directors living overseas can still apply online if they can verify their identity with myGovID.

Penalties

The harsh penalties that can be imposed, offer a great incentive to obtain a director ID on time and comply with the ongoing rules. Civil and criminal penalties of up to 60 points ($13,320), or a criminal penalty of up to one year imprisonment can apply where an individual:

■ fails to apply for a director ID when required to do so (see earlier timeframes)

■ intentionally applies for more than one director ID

■ provides a false director ID, or

■ is actively contravening one of the above offences.

Directors of an SMSF corporate trustee who fail to obtain a director ID may be forced to step down as a trustee and potentially leave the fund.

Take-home messages

■ All directors should apply for their director ID well before the relevant deadline.

■ Directors should also take care when applying for their director ID. They must only apply via the abrs.gov.au website as it is a secure site that will keep your information safe.

Where there’s a will, there’s often a dispute.

From wine-fuelled political debates over Christmas lunch to overly competitive games of Monopoly, there are many reasons family members can find themselves at loggerheads with one another. A particularly serious scenario is when a parent passes away and leaves behind an estate that becomes a source of bitter conflict between siblings.

There’s a common misconception that your will represents the incontrovertible ‘final word’ on what is to happen with your estate – ie, your home, possessions, savings and any other assets you may have – when you’re gone. However, this is not necessarily the case, and a 2016 report by government and the University of Queensland found that where wills are contested, the claimants are generally successful – in fact more than three in four times in the case of partners/ex-partners and children.

The table on the following page shows some of the common grounds for why cases over inheritance are brought before a court, and how they can be avoided.

For better or worse, no will is iron-clad – but there are simple measures you can take to help ensure your wishes are executed exactly as intended when you are gone. Aside from being aware of the common scenarios overleaf and what can be done to decrease their chances of arising, it may be best to consider:

■ Engaging the assistance of a professional.

■ Avoiding DIY will kits or at least seeking assistance when completing one.

■ Revisiting your will at least once every few years, especially if your life circumstances have changed (eg, as a result of marriage or divorce).

Superannuation budget measures one step closer.

Several superannuation proposals announced in this year’s Federal Budget have been introduced into Parliament in the Treasury Laws Amendment (Enhancing Superannuation Outcomes for Australians and Helping Australian Businesses Invest) Bill 2021.

These measures – all due to start on 1 July 2022 – aim to:

■ improve flexibility for Australians preparing for retirement

■ reduce costs and simplify reporting for SMSFs

■ expand the superannuation guarantee (SG) to lower income earning individuals, and

■ support more Australians to own their first home.

The superannuation measures that have been introduced include:

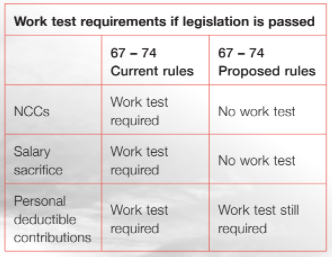

Repealing the work test for individuals aged 67 to 74

Start date: 1 July 2022

Individuals aged 67 to 74 will be able to make or receive non-concessional contributions (NCC) or salary sacrifice superannuation contributions without meeting the work test, subject to existing contribution caps.

However, individuals aged 67 to 74 years wanting to make personal deductible contributions will still have to meet the existing work test.

Removing the work test for individuals aged 67 to 74 will provide more flexibility for retirees under 75 to top up their superannuation without needing to work 40 hours within 30 consecutive days in a year prior to making a contribution. It will also allow advisers to implement strategies, such as the re-contribution strategy, that are not normally available to retired clients in this age group.

The table below summarises the key changes.

Note – the removal of the work test will not enable individuals approaching age 75 to access the bring forward rule for years in which they have no cap space. This is because under current legislation, individuals are not able to make voluntary superannuation contributions beyond the age of 74, so allowing an individual who is aged 74 to bring forward two years’ worth of NCC contributions would enable them to access a contribution period for which they are not entitled to.

Reducing the eligibility age for downsizer contributions to 60

Start date: 1 July 2022

The eligibility age to make a downsizer contribution will be reduced from 65 to 60 years of age. All other eligibility criteria that currently apply to downsizer contributions will continue to apply.

To recap, the downsizer contribution rules allow individuals to make a one-off after-tax contribution to superannuation of up to $300,000 (or $600,000 per couple) from the proceeds of selling their home they have held for at least 10 years. Under the rules, both members of a couple can make downsizer contributions for the same home and the contributions do not count towards an individual’s NCC cap.

Reducing the eligibility age for downsizer contributions to age 60 could allow an eligible couple in their early sixties to sell their home and contribute up to $1,260,000 to superannuation in a year by each making a downsizer contribution of $300,000 and NCCs of $330,000.

Providing SMSFs choice to calculate exempt current pension income

Start date: 1 July 2022

SMSF trustees will be able to choose how to calculate exempt current pension income (ECPI) where the fund is fully in the retirement phase for part of the income year but not for the entire income year.

In other words, choice applies where a SMSF has member interests in both accumulation and retirement phases at one time, but only retirement phase interests at another time in an income year.

Currently, the ATO holds the view that the assets of the fund will be segregated during this period (ie, when the fund is fully in retirement phase) meaning the fund may need to use both the segregated and proportionate methods for calculating ECPI for the one year.

This change will allow trustees to choose to apply the proportionate (or unsegregated) method for the whole of the income year based on a single actuary’s certificate, rather than being required to use different methods to calculate ECPI for different periods in the same income year.

However, the choice only applies if the SMSF does not have disregarded small fund assets (DSFA).

To recap, an SMSF is regarded as having DSFA where the fund:

■ pays a retirement phase pension at any time during the financial year, and

■ a fund member has a total superannuation balance of $1.6 million or more on 30 June of the previous financial year, and

■ the same member is receiving a retirement pension from any fund (not necessarily the SMSF).

Points to note about making a choice:

■ Trustees will be able to choose which method to use and calculate ECPI before submitting the fund’s SMSF annual return.

■ This choice is not a formal election and does not have to be submitted to the ATO. However, it is expected that trustees will keep a record of any choice they make and the details of the calculation they use.

■ If the trustee does not make a choice, then the fund’s ECPI will be calculated using the segregated method for any period of the income year where all of the interests in the fund are in retirement phase for some, but not all, of the income year.

To summarise, an SMSF will only be able to exercise this choice if:

■ all of the interests in the SMSF are in retirement phase for some, but not all, of the income year, and

■ all of the income derived from the SMSF’s assets is supporting retirement phase income stream benefits payable from an allocated pension, market linked pension or an account-based pension, and

■ the SMSF does not have DSFA.

Removing the $450 per month minimum SG threshold

Start date: 1 July 2022

The $450 per month minimum SG income threshold will be repealed. As a result, employers will be required to make quarterly SG contributions on behalf of low- income employees earning less than $450 per month (unless another SG exemption applies).

Under the current rules, an employer is not required to pay SG contributions for an employee who earns less than $450 per month.

The two main rationales for the $450 threshold were to:

1 . Minimise the administrative burden on employers administering small amounts of superannuation contributions. However, technological advances and the digitalisation of payroll systems, for example Single Touch Payroll, diminishes the rationale for a minimal threshold which adversely impacts low-income workers and women.

2 . Prevent the creation of low-balance accounts that could get eroded by fees and insurance premiums. However, recent Government changes have reduced the impact of these risks.

This measure will benefit an estimated 300,000 people or 3% of employees1. These people are mainly young and/or lower-income and part-time workers, and around 63% are female2. These changes will help these workers to start accumulating superannuation earlier as well as help address the gap in superannuation savings between women and men.

1 Estimates based on ATO Single Touch Payroll data for July 2019, provided to the Retirement Income Review, published in the

Retirement Income Review – Final Report. Canberra: Commonwealth of Australia, 2020, pp 298, 301.

2 Ibid, pp 45, 300-301

This information has been prepared without taking into account your objectives, financial situation or needs. Because of this, you

should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs.

Increasing the first home super saver scheme (FHSSS) releasable amount to $50,000

Start date: 1 July 2022

Since 1 July 2017, individuals can make voluntary concessional contributions (CC) and NCCs into superannuation and have them released to help pay for their first home. The maximum releasable amount of eligible voluntary CCs and NCCs under the FHSSS will be increased from $30,000 to $50,000.

Under the new rules, the maximum amount of voluntary contributions that are eligible to be released remains at $15,000 per financial year and $50,000 in total. The individual will also receive an amount of earnings that relate to those contributions.

Therefore, an individual would need to contribute over four years to take maximum advantage of the scheme under this measure.

ATO’s ABN cancellation program continues

You may need to take action to prevent the cancellation of your ABN.

The ATO has announced that it is continuing to review inactive Australian Business Numbers (ABNs) for cancellation. Your ABN may be selected for review if you have not reported business activity in your tax return, have not lodged activity statements that include business income, or there are no other signs of business activity in other lodgements or third-party information. This includes running a legitimate business but forgetting or neglecting to lodge tax returns and activity statements.

If your ABN is cancelled, you have no legal business. This means you are operating illegally.

The purpose of cancelling inactive ABNs is to ensure information on the Australian Business Register (ABR) is correct and up-to-date. Emergency services and government agencies use information from the ABR during natural disasters to identify where financial disaster relief is needed to help businesses.

Your customers and suppliers may also use the ABR to verify that they are dealing with a legitimate business (particularly at the commencement of a business relationship). If there is no ABN appearing on the register, then that customer or supplier will likely withhold 45% of any payments due to your business, and may subsequently cease to deal with you. Further, other businesses need a valid ABN from you on tax invoices you provide them with in order to claim GST credits in relation to purchases from you.

ABN cancellation scenarios

■ If your ABN is identified for cancellation, the ATO may contact you and advise what actions you need to take in order to prevent them cancelling it. This

may include lodging outstanding returns of activity statements showing business income.

■ If you are no longer in business, you do not need to take any action.

■ If your ABN is cancelled but you are still carrying on an enterprise and believe you are entitled to one, you will need to reapply to reactivate it via www.abr.gov.au.

When reactivating a cancelled ABN, you can list your previous ABN on the application for a new ABN. Reactivating a cancelled ABN is free, however you may be charged a fee if your business name needs to be re-registered.

The ATO may conduct a manual review when you reactivate a cancelled ABN. Generally, this will determine your eligibility and entitlement for a ABN. Eligibility depends upon whether you are carrying on an enterprise.

You can reapply for the same ABN if your business structure remains the same. However, if your business structure has changed, you will need to apply for a new ABN (for example, if you were a sole trader, but you now operate through a company structure).

You may wish to contact your accountant for assistance on any of the above.