JobKeeper rules and obligations

Legislation relating to the extension of the JobKeeper Payment scheme was passed last week. The extension of the scheme will allow additional assistance to eligible employers from 28 September 2020 through to 28 March 2021.

Jobkeeper 2.0 measures announced

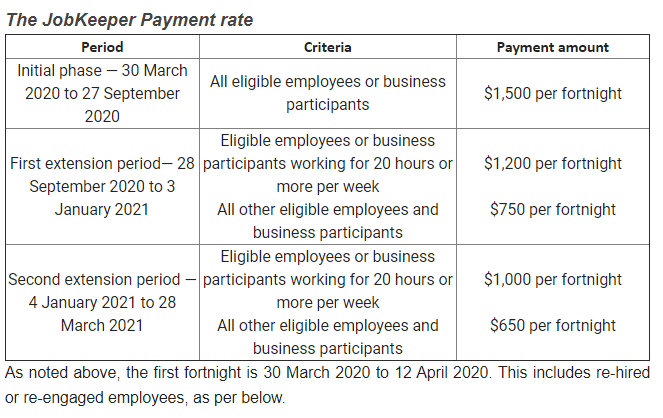

The original JobKeeper Payment scheme was brought in to subsidise wage payments for eligible businesses affected by the COVID-19 pandemic. The initial payments comprised of a payment of $1,500 per fortnight, for each eligible employee as at 1 March 2020, for six months (13 fortnights) from 30 March 2020 to 27 September 2020.

The scheme has now been extended past September, to March 2021 and this new phase of the scheme is commonly referred to as Jobkeeper 2.0. From 28 September 2020, the payment will be reduced to $1,200 per fortnight, and down again to $1,000 per fortnight from 4 January 2021. Eligible businesses can be structured as sole-traders, partnerships, trusts or companies.

Payments will be made by the ATO monthly, in arrears. Payments will be scheduled to end by 28 March 2021.

Eligibility criteria

Qualification for the scheme

For a business to qualify for the first extension of the scheme, it must:

• have at least a 30% reduction in turnover for the September and December 2020 quarters compared to a year ago (50% reduction for businesses greater than $1b in turnover and 15% reduction for registered non-profits and Australian charities). The decline in turnover test changes after September 2020 in the following ways:

- the business must compare their September 2020 quarter’s turnover, with their turnover for the same quarter a year ago in order to qualify for the first extension for September to January payments, and

- the business must compare the December 2020 quarter’s turnover, with the same quarter a year ago in order to qualify for the second extension for January to March payments.

Note that an entity will not automatically be eligible for JobKeeper in the Second Extension Period if it is eligible in the First Extension Period. Instead, it will be necessary to reassess the actual decline in turnover test at the commencement of the Second Extension Period.

• not be subject to the Major Bank Levy.

• for JobKeeper fortnights from 3 August 2020 onwards, have an employment relationship with employees that existed as at 1 July 2020, and

• confirm that each eligible employee is currently engaged.

For the JobKeeper extension, businesses and non-profits will generally be able to assess eligibility based on the details reported in their Business Activity Statements (BAS). Alternative tests will be introduced for businesses and non-profits that are not required to lodge a BAS.

As the September BAS is lodged by late October, and the December BAS is lodged by late February for quarterly lodgers, businesses and non-profits will need to assess their eligibility for JobKeeper in advance of the BAS deadline. They must do this to meet the wage condition, which requires them to pay their eligible employees in advance of receiving the JobKeeper payments.

The Commissioner of Taxation will have discretion to extend the time an entity has to pay employees to meet the wage condition, so that entities have time to first confirm their eligibility for the JobKeeper Payment.

Not-for-profit organisations and self-employed individuals will also qualify for the scheme, subject to those entities meeting the decline in turnover test.

An alternative test is also available for a business who either has:

• has only commenced operations within the past year, or

• extraordinary circumstances.

In the alternative test, an employer may qualify by being granted an allowance by the ATO.

Self-employed qualification rules

Where a person is self-employed by a business and does not receive a salary, the business may elect an “eligible business participant” for JobKeeper. Only one eligible business participant will receive JobKeeper per entity.

The individual must:

• not be employed by the business

• satisfy business participation requirements, and

• satisfy nomination requirements.

Also, the individual must have a certain role in the entity to qualify, as listed below:

• Sole trader – the individual

• Partnership – a partner

• Trust – an adult beneficiary

• Company – either a director or a shareholder.

Applying for the payment

Once a business self-assesses that they qualify for the scheme, certain criteria is still required to be met to receive ongoing JobKeeper payments.

As stated above, the business needs to ensure which employees meet the eligibility requirements to receive the JobKeeper Payment. Exclusions apply to individuals who have been on casual employment for less than 12 months, people under 16 and those without correct residency visas.

All the eligible employees are required to be notified, in writing, that the business is intending to claim the JobKeeper Payment on their behalf. As part of this notice, the employee is required to acknowledge that they will not receive the JobKeeper payments from another employer (if necessary). The notification process includes sending the ATO’s JobKeeper employee nomination notice. This notice is required to be returned to the business before they can claim the JobKeeper amount.

Each employee is required to be paid based on the table below per fortnight (before tax) for each fortnight the business wishes to claim JobKeeper.

Re-hire/Re-engaging employees

In certain situations, a business may have ‘let go’ or ‘stood down’ staff during the month of March at the commencement of COVID-19 restrictions. A critical aspect of the JobKeeper Payment is the continuing relationship between employer and employee.

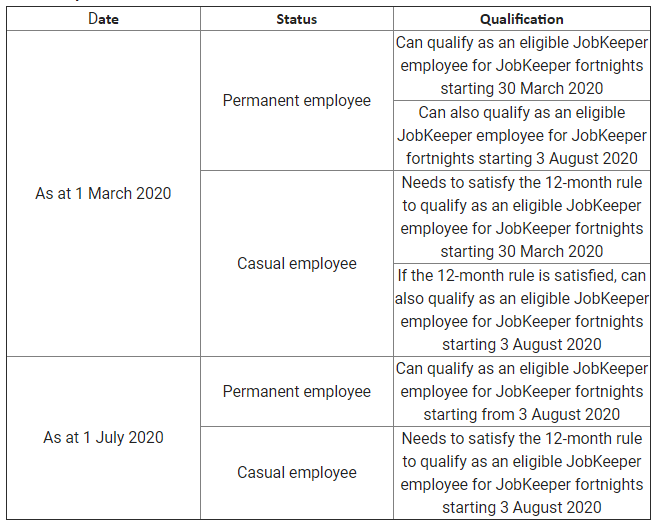

Therefore, as long as the employee was engaged as an employee at 1 March 2020 for the initial JobKeeper Payment, or at 1 July 2020 for JobKeeper fortnights starting from 3 August 2020, businesses are able to re-hire or re-engage employees in order to pay them JobKeeper Payment. Existing employees who qualify as pre-1 March 2020 hires, do not need to qualify again for the new 1 July 2020 hire date, even if they were let go and hired after 1 July 2020. Please see the table below for more details:

The amount of JobKeeper payments paid from the ATO to the business is based on when the employees were re-hired. Additional arrangements which accompany the JobKeeper rules allow the ATO to treat a particular event as happening in a different fortnight to when it actually happened. This allows the ATO to provide a reasonableness test for employees who were re-hired.

JobKeeper — Enrolment, lodgements and making changes

The enrolment and management process is controlled by the ATO. All businesses should use the Business Portal and myGovID to register for JobKeeper payments. A tax agent can also complete this for their clients.

Each month, businesses are required to reconfirm that the employees of the business remain eligible. Therefore, businesses are required to make any subsequent changes to the employees’ details in the event of them leaving or changing employment. This can be done through your accounting software’s payroll system (single-touch payroll).

Monthly declarations from August 2020

The ATO has advised changes for businesses making their August declaration, in line with changes from JobKeeper fortnight 10, commencing 3 August 2020. This monthly declaration is due by 14 September 2020.

Employers need to include their new employees, or long-term casuals, who now qualify as at 1 July 2020.

The ATO has also advised that an extension for meeting the wage condition is allowed for these newly eligible employees, to 31 August 2020.

Further actions

One main facet of the JobKeeper Payment is that the amounts paid from the ATO to the business is to be passed on to the employees. As the expense of paying employees for services is a deductible expense, the JobKeeper payments are assessable income of the business.

There are further measures in place within the updated Fair Work Act in order to protect employees. One such measure is allowing businesses to order staff to work fewer hours (including nil hours) in response to the COVID-19 pandemic.

Also, to protect employees a “minimum payment obligation” has been enacted to ensure that employees are compensated on their regular working wage. This means that employees who work less hours than normal, but entitled to earn more than the stated amount per fortnight, receive adequate compensation from their employer.

Extension of Fair Work Act provisions

Included in this new legislation are extensions to the relevant Fair Work Act 2009 provisions which allow employers to temporarily vary the working arrangements of employees. These variations are typically called “JobKeeper enabling directions”. The JobKeeper enabling directions include standing down employees, effectively reducing their hours in line with the JobKeeper wage condition (or even down to zero hours). Also, employers and employees can agree on changes to work duties, work locations and working hours. However, employers need to ensure that base and penalty payment rates are retained, as well as allowing employees to get secondary employment or undertake training/education courses.

Amendments to the Fair Work Act 2009 are required to align the rules with the changes to the JobKeeper Payment scheme. Effectively, the JobKeeper Payment scheme extension period requires employers to qualify for JobKeeper for each quarter from 28 September 2020, where previously an employer only had to qualify at a point in time.

The change in the JobKeeper qualification rules means that, for the purposes of the Fair Work Act 2009, two broad categories of employer will exist during the extension period:

• Qualifying employers — employers who are eligible for JobKeeper on behalf of their employees both before and after 28 September 2020.

• Legacy employers — employers who were eligible for JobKeeper payments prior to 28 September 2020, but do not qualify on or after this date.

Changes for all employers

Changes were temporarily made to the Fair Work Act 2009 in relation to annual leave in April 2020. These changes meant that employers who qualified for JobKeeper could request that eligible employees take annual leave, so long as at least two weeks remained.

This temporary measure is due to be automatically repealed on 28 September 2020, the end of the original JobKeeper payment period. The changes to the Fair Work Act 2009 do not change the repeal of the annual leave JobKeeper enabling direction. That is, employers will not be able to set a direction for JobKeeper eligible employees to take annual leave during the JobKeeper period.

Qualifying employers

Annual Leave Direction – A qualifying employer will need to demonstrate to the ATO that they will continue to qualify for JobKeeper payments. This is in line with their quarterly lodgements and requires them to meet a decline in turnover test (generally 30%). Full details can be found under the heading ‘Jobkeeper 2.0 measures announced’ above.

JobKeeper Enabling Directions – For the JobKeeper extension period, qualifying employers will retain the full range of JobKeeper enabling directions, except for the annual leave direction above.

JobKeeper enabling directions currently in place with employees on 27 September 2020 will automatically carry over from 28 September 2020 if the employer remains eligible to give that direction or make that agreement in those terms. However, the employer may revoke any direction given.

Legacy employers

There will be employers who qualified and received original JobKeeper payments between 30 March 2020 and 27 September 2020, who will be ineligible after this date. These employers are known as “legacy employers” for the purposes of the Fair Work Act 2009.

Legacy employers who have a certificate stating that they have experienced a 10% decline in turnover will temporarily have access to modified JobKeeper enabling directions.

10% decline in turnover test

To be eligible for modified JobKeeper enabling directions, the employer must hold an applicable written certificate stating that they satisfy the 10% decline in turnover test. The 10% decline in turnover test has the exact same rules as the JobKeeper Payment Rules. This means that, for the purposes of the Fair Work Act 2009, the test will capture employers with a decline in turnover between 10% and their applicable JobKeeper rate (either 15%, 30% or 50% depending on the entity).

The 10% decline in turnover certificate is required to be completed by an eligible financial service provider. An eligible financial service provider is defined in the Fair Work Act 2009 as a:

• registered tax agent or BAS agent, or

• qualified accountant.

However, a financial service provider cannot be a director, employee or an associated person of the employer.

Certificates

An eligible written certificate is only valid for a set amount of time and needs to be issued before the employer can utilise the modified JobKeeper enabling directions. The eligible 10% decline in turnover certificates relate to the following periods:

• Between 28 September 2020 and 27 October 2020, a legacy employer must have had a 10% decline in turnover in the June 2020 quarter, compared to the June 2019 quarter.

• Between 28 October 2020 and 27 February 2021, a legacy employer must have had a 10% decline in turnover in the September 2020 quarter, compared to the September 2019 quarter.

• Between 28 February 2021 and 28 March 2021, a legacy employer must have had a 10% decline in turnover for the December 2020 quarter, compared to the December 2019 quarter.

The written certificate must relate to a specific employer. Also, the certificate must state that, in the opinion of the financial services provider, the employer satisfied the 10% decline in turnover test for the designated quarter.

For a legacy employer who wishes to use JobKeeper enabling directions for the entire JobKeeper extension period, they will need 3 certificates to be issued.

An original JobKeeper employer who does not satisfy the 10% decline in turnover test for a specific period may still qualify for modified enabling directions in a later period. However, the employer is required to hold a relevant certificate prior to commencing a JobKeeper enabling direction.

If a legacy employer fails to satisfy the necessary tests during the extension period, they must notify their employees that any stand down notice no longer applies. That way, an employee of a legacy employer is notified either way whether any previous change to their employment contract is in effect or has changed. Any change during the extension period will be accompanied by a relevant certificate.

Small business employers and statutory declarations

The Fair Work Act 2009 defines a small business employer broadly as an entity with fewer than 15 employees.

Instead of getting a 10% decline in turnover certificate from their accountant or tax agent, a small business employer can choose to complete a statutory declaration. The statutory declaration must made by an individual who has appropriate knowledge of the financial affairs of the small business employer.

The statutory declaration must state that the declarant is satisfied that the small business employer satisfies the 10% decline in turnover test for the relevant quarter. Like the certificates, the statutory declaration is only valid for a specific period (listed above).

Modified JobKeeper enabling directions

Under the Fair Work Act 2009, JobKeeper enabling directions can only be in effect if the employer is receiving a JobKeeper payment for a particular employee. For legacy employers in the extension period, a modified JobKeeper enabling direction can only be in effect for an employee for whom a JobKeeper entitlement was previously claimed.

The following are the major modifications to the rules for legacy employers.

• A stand down direction can be for no less than 60% of the employee’s ordinary hours as at 1 March 2020.

• A stand down direction cannot require the employee to work for less than 2 consecutive hours in a day.

• A legacy employer must give a longer period of notice before giving a modified JobKeeper enabling direction, being 7 days rather than 3.

An employer still may direct the employee to specific duties of work, or the location work, as long as other requirements are met. A modified JobKeeper enabling direction can still request employees to perform duties on different days or at different times (as long as the agreement doesn’t require the employee to work less than 2 consecutive hours in a day).

The 60% stand down direction means that an employee who was working 38 hours per week as at 1 March 2020 as a full time employee can only be reduced to 22.8 hours per week.

Also, a legacy employer is required to pay the employee at their base hourly rate for these hours.

Ordinary hours are defined to mean hours contracted to work, as set out in the employee’s industrial instrument or contract of employment.

Example (adapted from Explanatory Memorandum)

Matthew works as a receptionist in Nishtha’s gym. On 1 March 2020, Matthew was employed as a full-time employee. This means that at the requisite time, his ordinary hours under the Fitness Industry Award 2010 were 38 hours per week.

In late March 2020, Nishtha’s gym closed due to government restrictions and qualified for the JobKeeper scheme in relation to Matthew.

In June 2020, Nishtha reopened the gym, but for reduced hours. She gave Matthew a JobKeeper enabling stand down direction reducing his hours from 38 to 15 per week until 27 September 2020.

By 28 September 2020, Nishtha’s business has started to recover financially and will not qualify for JobKeeper payment extension. However, the business has a decline in turnover of at least 10% when comparing actual GST turnovers in the June 2020 quarter to the June 2019 quarter. Nishtha subsequently obtained a certificate from an eligible financial service provider.

Nishtha wants Matthew to continue to work reduced hours because the gym still hasn’t returned to its normal opening times. As Nishtha is a legacy employer, Matthew’s hours can only be cut to a minimum of 22.8 hours per week (60% of 38 ordinary hours on 1 March 2020) during the extension period. Nishtha gives Matthew a new JobKeeper enabling stand down direction to the minimum hours. The stand down direction includes at least 2 consecutive hours on each day Matthew works – he works 5 hours on Monday, Tuesday and Wednesday and 7.8 hours on Thursday. Nishtha gives Matthew seven days written notice of her intention to give this direction, consults Matthew about the direction during the seven days prior to making the direction and keeps a written record of this consultation.

The new direction applies from 28 September 2020 until 27 October 2020. Once the September quarter is complete, Nishtha must obtain a new 10% decline in turnover certificate for the September 2020 quarter.

She needs to notify Matthew before 28 October 2020 that the JobKeeper enabling stand down direction will not cease to apply to him on that date. She notifies Matthew and provides him with the new certificate, meaning the direction then applies until 27 February 2021.

Nishtha’s gym starts to recover in the December 2020 quarter, meaning the gym no longer satisfies the 10% decline in turnover test. Nishtha is not be eligible to give Matthew a JobKeeper enabling direction for the subsequent period. She needs to notify Matthew before 28 February that the gym no longer satisfies the test for the December 2020 quarter.

The notification states that the JobKeeper enabling direction will cease to apply to him on that date, and he is to resume a 38 hour week.

Matthew’s base rate of pay under the Fitness Industry Award 2010 is $21.54 per hour, which cannot be reduced for his hours of work, regardless of the actual number of hours he works.

Risk mitigation steps

Civil penalties are in place for entities who knowingly making a false statement in relation to satisfying the 10% decline in turnover test. This includes where an employer was reckless as to whether the test was satisfied and provided misleading information in order to obtain a 10% decline in turnover certificate. The civil penalties are 60 units ($13,320) for an individual or 300 units ($66,600) for a body corporate.

Please contact us if you require help with any of the above.

Yours faithfully,

The team at

Brett Wiseman – Director

brett@interacctbc.com.au Ph: 0402 281 888

James Rogalski – Director

james@interacctbc.com.au Ph: 0428 858 818

Carly Thornton – Director

carly@interacctbc.com.au Ph: 0438 007 054

Cherie Parker – Accountant

cherie@interacctbc.com.au Ph: 08 8683 3077

Tracey Barnes – Accountant

tracey@interacctbc.com.au Ph: 0429 906 661